Purchasing a house or property is one of life’s biggest wins. It requires a lot of money, time, and patience. In December 2024, the median price of a house was $427,179.

While you’re negotiating a real estate deal, you need to pay extra attention to the sale closing to ensure everything goes smoothly.

If you’re a first-time home buyer and need to know the important tips to keep in mind while closing a deal, go through this checklist!

1. Get A Mortgage Pre-Approval

Getting your mortgage pre-approved is a good idea even before you start looking at houses unless you’re planning to buy everything in cash.

Of course, being pre-approved doesn’t necessarily mean closing a real estate deal. Most sellers prefer customers who have the pre-approval letter. This is because having one can speed up the process significantly and also give the buyer more bargaining power while negotiating prices.

Mortgage pre-approval shows that you’re a responsible buyer with enough financial backing. Moreover, it lets you know the maximum limit up to which you can purchase any property.

2. Conduct Inspections

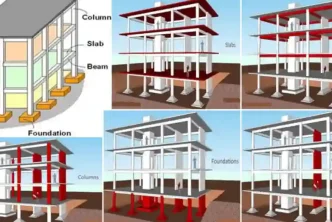

Conducting a detailed inspection before closing the deal is also necessary before you start closing the deal. It’s always advisable to get help from a professional attorney who will accompany you during the inspections.

For example, if you’re buying a house in California, talk to a real estate lawyer in California who specializes in home inspections.

Check every part of the property carefully to ensure that it’s in good condition and that the seller’s terms match your expectations. This includes checking out the wiring, HVAC systems, plumbing, sewage, and any other amenities listed in the advertisement or selling pitch.

3. Make A Clear Contract

Needless to say, you’ll draft contracts before closing the sale, but the specifics of the document require a good amount of time and effort. In California, for example, the closing documents include the deed, bill of sale, mortgage documents, and closing statements.

When you buy the property, you need a five-page form called closing disclosure that details the loan and outlines closing costs.

You should also do a title search that states that the property is free from claims and liens. All documents should be precise and contain clear terms and conditions for both the buyer and the seller.

4. Open An Escrow Account

An escrow account is held by a third-party provider on behalf of the buyer and the seller. Remember, a home sale involves weeks and months of thorough searching and document drafting.

As a buyer, you want to ensure that nobody cheats on your time and money, especially during the sale’s closing. This is done by bringing in a neutral third party or escrow.

They hold all the money and important documents until the transaction is done, ensuring that both parties are satisfied. When the deal is closed, the money and documents are delivered from the escrow account to the buyer’s account.

5. Know The Ownership

Obtaining a title is the legal process of establishing your ownership of the property. There can be several variations on the procedure, although it’s important to establish your title as soon as possible.

There are five main ways to take the title: Sole and Separate, Community Property, Community Property with Right of Survivorship, Joint Tenancy with Right of Survivorship, and Tenants in Common.

If you’re unsure which method applies in your case, talk to a real estate agent to figure it out. You should also seek an attorney’s advice on speeding up the ownership process and ensuring a smooth transfer.

6. Negotiate Closing Costs

Every service costs quite a lot of money when you’re buying a home. And sellers would always want you to buy the house at high prices.

However, you need to negotiate and reach a conclusion that suits both of you the best. If you’re not careful enough while negotiating, the money can snowball into a huge amount.

During the closing costs, outline things like pest control, home inspection, and costs associated with parking vehicles and garage maintenance.

Even fees for legitimate closing procedures can be highly inflated, so always keep room open for negotiation, especially when it comes to junk fees imposed by the buyer.

Parting Words

Besides these, remember that interest rates while purchasing real estate can be pretty volatile, so always lock in your interest rate for the loan in advance. This will prevent you from being affected by market fluctuations during the deal closing.